Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Giorgio Armani, the iconic Italian fashion designer, passed away at 91 and left the industry buzzing with his last business move. Armani Will Instructs Heirs to sell a 15% minority stake in the company within 18 months, giving first dibs to LVMH, Essilor-Luxottica, or L’Oreal.

It’s a bold twist for someone who spent decades dodging takeover offers. The will lays out exactly who gets what, splitting control among family and Armani’s closest business allies.

Leo Dell’Orco, Armani’s right-hand man and head of menswear, walks away with 40%. Niece Silvana Armani and nephew Andrea Camerana each get a 15% slice.

The Armani Foundation takes 30% of the company and steps in as the permanent guardian of the brand’s core values.

The will also leaves room for buyers to bump their stake above 50% within five years, or—if things don’t work out—go public instead. That’s a lot to unpack for a label so famously independent.

Armani’s will spells out a step-by-step plan to shift ownership through a structured sale process. He singles out certain luxury conglomerates as preferred buyers, and the document sets clear rules for private sales or a possible market debut.

The Armani Foundation has to sell a 15% minority stake in the brand, but there’s a catch. They can’t start until a year after Armani’s death, and they need to wrap up the sale within 18 months.

This first sale kicks off the bigger succession plan. The waiting period is meant to keep things steady right after Armani’s passing—probably a wise move.

The Armani Foundation holds onto 30% of the company and acts as “a permanent guarantor of compliance with the founding principles.” That’s Armani’s way of keeping the brand’s DNA intact, even if new partners come on board.

Three big names get first shot at buying into the Armani Group. LVMH, Essilor-Luxottica, and L’Oreal are specifically named in the will.

Here’s how the shares break down:

Other family members get non-voting shares. Roberta Armani and Rosanna Armani each hold a 15% non-voting stake.

The will sets a timeline for bigger changes down the road. Within three to five years, the same buyer should grow their stake to 30%–54.9%.

If private sales stall, an IPO is on the table—Italy or another fashion hub could host it. This approach gives the brand options, which honestly feels pretty modern for such a storied house.

The structure gives Armani’s heirs some wiggle room while still sticking to his vision. It’s a balancing act between tradition and the realities of today’s luxury market.

Giorgio Armani’s plan splits up control between family and key execs, with Leo Dell’Orco getting the biggest piece at 40%. Silvana Armani and Andrea Camerana, both family, each take 15%. The Armani Foundation holds 30% and watches over everything.

Leo Dell’Orco picks up the largest single stake—40% ownership. He’s been by Armani’s side for years, running menswear and shaping the brand’s look.

His stake makes him the most influential person in the company’s next chapter. Dell’Orco’s deep understanding of Armani’s aesthetic puts him in a strong position to steer the brand.

The executive committee backs Dell’Orco to carry out short and medium-term plans. He also inherits 40% of Armani’s 2.5% stake in Essilor-Luxottica—worth about 2.5 billion euros. Not too shabby.

Silvana Armani, Giorgio’s niece and the head of womenswear, gets 15% of the company. Andrea Camerana, his nephew, receives the same.

Both hold voting shares, so they have real say in the business. Together, they bring a strong family presence to the boardroom.

Silvana’s been hands-on with the women’s collections for years, so she’s key to keeping things consistent. Andrea brings another family perspective to leadership.

Rosanna Armani, Giorgio’s sister, and Roberta Armani, his niece, each get 15% non-voting shares. They benefit financially but don’t get a say in major decisions.

Roberta’s long served as the bridge between Armani and A-list clients. Her Hollywood connections still matter for the brand’s image.

Both Rosanna and Roberta also inherit parts of Giorgio’s personal fortune and real estate—think Milan, New York, Sicily, and St. Tropez. Not a bad legacy.

The Armani Foundation commands 30% of the company and has the job of protecting Giorgio’s vision. He set up the foundation in 2016 just for this purpose.

First up, the foundation needs to name a CEO to keep the company on track. The foundation can’t own less than 30%, so it always holds veto power.

This setup keeps the company independent and true to Armani’s style, while still leaving the door open for smart partnerships. It’s a safeguard for that signature understated elegance.

The instructions in Armani’s will to sell off control send shockwaves through one of the last big independent luxury houses. Now, three giants have priority access to the Italian fashion legend.

The gradual sale plan sets a clear timeline—15% must go within 18 months, and more (up to nearly 55%) over the next five years.

This structure helps protect the brand’s core. The Armani Foundation keeps a permanent 30% grip, acting as the brand’s conscience.

Leo Dell’Orco, with his 40%, leads the way through this transition. With his background, he’s probably the best shot at keeping things steady.

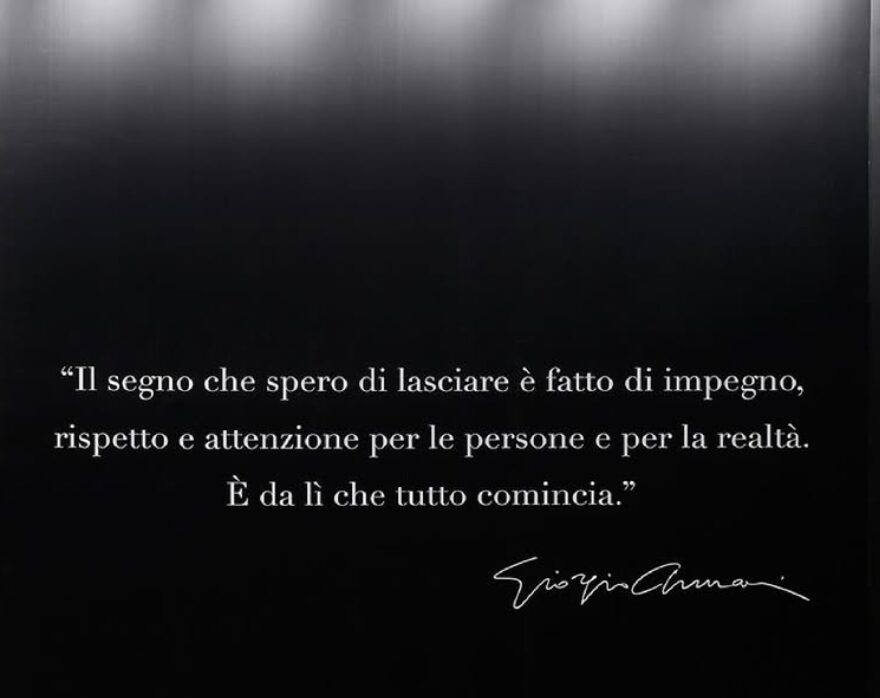

The will even sets style rules—future collections have to stay “essential, modern, elegant and understated.” That’s classic Armani, and it should keep new owners from making wild changes.

Three companies get the first look at buying in. LVMH owns heavyweights like Louis Vuitton and Dior.

Essilor-Luxottica dominates eyewear and already works with Armani on Emporio Armani glasses. L’Oreal brings serious beauty and cosmetics muscle, which could push Armani further into luxury beauty.

What each buyer brings to the table:

If these three pass, the will allows sales to other top-tier fashion groups. The next chapter for Armani is wide open—and, honestly, it’s going to be fascinating to watch.

Armani’s controlled sale stands in stark contrast to the way other Italian fashion houses changed hands. Gucci joined the Kering group after some wild takeover battles back in the ’90s.

Armani’s approach keeps more control during the transition. The foundation structure and slow sale timeline help shield against hostile takeovers.

Gucci’s integration into Kering definitely brought growth, but it also shook up company culture. Armani’s will tries to guard against that by making buyers respect the original principles.

Most big Italian fashion brands now sit under foreign ownership. Gucci is part of the French Kering group, while Versace went to the American company Capri Holdings.

With Armani’s sale, it feels like we’re seeing the last of the independent Italian fashion houses. The trend toward consolidation under giant luxury conglomerates just keeps rolling.

Giorgio Armani built his fashion empire on creative control and a kind of pared-back elegance that’s defined luxury for decades. His business philosophy was all about staying independent and creating timeless pieces that balance sophistication with wearability.

Armani spent his whole career protecting his brand from outside control. He turned down offers from the big luxury groups—LVMH, Gucci, Kering, all of them.

He even said no to the Agnelli family, the Fiat founders. That kind of resistance is pretty rare in Italian fashion these days.

His insistence on independence let him keep both creative and business control. That’s how he managed to keep his vision alive for more than 50 years.

The house became famous for unstructured suits and refined tailoring. Those designs helped put Italian fashion on the global luxury map.

Armani left clear instructions for how his brand should move forward after his death. His will says future collections should focus on “essential, modern, elegant and understated design with attention to detail and wearability.”

These principles are really the backbone of his brand identity. He always preferred clean lines over loud trends.

Key Design Elements:

Armani’s final collections will be shown at Milan Fashion Week. These pieces are his last creative statement, closing out his legacy at age 91.

The Armani Foundation now controls 30% of the fashion empire in this new ownership setup. Giorgio Armani created this foundation back in 2016 for succession planning.

The foundation acts as a permanent guardian of the brand’s core values. It will always hold at least 30% of shares, serving as the “permanent guarantor of compliance with the founding principles.”

Its first big job is naming a new CEO. That person will help steer the company through this transition.

The foundation also has to oversee the gradual sale of shares. It’ll make sure buyers really get what Armani’s design philosophy and business values are all about.

Giorgio Armani’s will lays out specific steps for his heirs to gradually sell the fashion empire he spent 50+ years building. The will names preferred buyers and sets a timeline for passing the torch, all while trying to keep the brand’s Italian soul intact.

The will tells heirs to sell an initial 15% stake within 18 months of Armani’s death. That’s just the first step in a longer, phased transfer.

Three to five years after his death, heirs have to transfer another 30% to 54.9% stake to the same buyer. This gives everyone time to adjust, rather than forcing a quick sale.

If they can’t find a suitable buyer, the will says heirs should go for an IPO. That public listing should happen in Italy or another market with similar status.

The Fondazione Giorgio Armani will keep a strong hand in the company’s direction. Together, the foundation and Armani’s life partner Pantaleo Dell’Orco control 70% of voting rights in the group.

If the company goes public, the foundation will keep a 30.1% stake. That should guarantee some real oversight of brand decisions.

Both the foundation and Dell’Orco need to agree on any potential buyers. That approval process is meant to keep the brand out of the wrong hands.

The will gives priority to LVMH, L’Oreal, and EssilorLuxottica. These companies are specifically named as top choices.

The will also lets the foundation consider other groups of “equal standing.” That gives them some wiggle room while still keeping standards high.

Heirs should also look at other fashion and luxury companies with existing commercial ties to Armani. Those connections might open up more sale options.

Armani died at 91 and left no children to inherit the business. That created a real succession problem for a private company like his.

The company’s profits have shrunk with the luxury industry slowdown. Even though revenue stayed steady at 2.3 billion euros in 2024, the financial pressure probably nudged the decision.

The sale instructions come as a surprise for a company so fiercely independent. Armani turned down plenty of acquisition offers during his life.

The gradual sale timeline gives some structure to a company that always answered to Armani alone. The 18-month window lets heirs weigh options and negotiate without rushing.

The foundation’s ongoing role means there’s continuity in brand management. Dell’Orco, as Armani’s life partner and business ally, brings operational know-how during the handoff.

Armani’s buyer preferences show how much he cared about maintaining brand standards. Requiring foundation approval adds another layer of protection for the future.

The Fondazione Giorgio Armani stands as the main guardian of the designer’s legacy. It actually holds the right to approve or reject any potential buyer, which puts a lot of power in their hands.

They seem to lean toward established luxury companies—think LVMH, L’Oreal, or EssilorLuxottica. These groups already know how to handle luxury brands, so it’s not a wild guess they’d keep Armani’s prestige intact.

Dell’Orco still plays a big role, bringing his deep knowledge of Armani’s design philosophy. By working closely with the foundation, he helps set up a kind of checks-and-balances system to protect the brand’s core values.