Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Building a strong credit score takes time and smart financial habits. Many people struggle with poor credit due to past mistakes or simply not knowing the right strategies to improve their scores. 10 Hacks for Building Credit.

Learning proven credit-building techniques can help anyone raise their credit score and unlock better financial opportunities. Simple changes like managing payment schedules, understanding credit utilization, and avoiding common mistakes can make a significant difference. These strategies work for people at any stage of their credit journey, whether they are starting from scratch or trying to repair damaged credit.

Payment history makes up 35% of a credit score calculation. This makes it the most important factor in determining creditworthiness. Late payments can damage a credit score for years.

Consistently making payments on time is a crucial building block for achieving a prime credit score. Even one missed payment can lower a score by 60 to 110 points.

Credit card companies typically report late payments to credit bureaus after 30 days past the due date. This means borrowers have a short grace period before their credit takes a hit.

Setting up automatic payments is one of the most effective ways to ensure bills get paid on time. A straightforward credit hack to help build credit is to set up autopay for credit accounts. This removes human error from the equation.

Borrowers can set up autopay for the minimum payment or full balance. Paying the full balance helps avoid interest charges. Paying just the minimum keeps the account current.

Most banks and credit card companies offer free autopay services through their websites or mobile apps. Borrowers need to ensure their checking account has enough money to cover the automatic payments.

Calendar reminders work well for people who prefer manual payments. Setting reminders 3-5 days before due dates gives time to make payments. Multiple reminders help prevent forgotten payments.

Mobile banking apps often send push notifications about upcoming due dates. These alerts help borrowers stay on top of their payment schedules. Many apps also allow quick payments directly from the notification.

Some people find it helpful to align all their due dates to the same day each month. Most credit card companies allow customers to change their payment due dates. This creates one “bill paying day” per month.

Making payments twice per month can also help with budgeting. Borrowers can split their monthly payment in half. This approach works well for people who get paid bi-weekly.

Late payment fees make it even more difficult to get caught up with payments. These fees typically range from $25 to $40 per occurrence. Avoiding late fees keeps more money available for paying down balances.

Credit card companies may raise interest rates after late payments. The penalty APR can be significantly higher than the regular rate. This makes it more expensive to carry a balance.

Some lenders offer grace periods for first-time late payments. Borrowers should call their credit card company if they miss a payment. Companies sometimes waive fees for customers with good payment history.

If someone can’t make a payment, they should reach out to their lender or credit card company as soon as possible. Many companies offer hardship programs or payment plans. These options are better than simply missing payments.

Payment history stays on credit reports for seven years. This means one late payment can affect credit scores for a long time. However, the impact lessens as time passes and positive payments accumulate.

Making payments early can provide extra protection against late fees. Some people pay their bills as soon as they receive them. This approach eliminates the risk of forgetting due dates.

Online bill pay through banks often allows users to schedule payments in advance. Borrowers can set up payments weeks before they’re due. The bank will automatically send the payment on the specified date.

Keeping track of multiple due dates requires organization. A simple spreadsheet or calendar can help manage payment schedules. Many people use the notes app on their phone for quick reference.

Credit utilization also affects scores, but payment history carries more weight. Someone with perfect payment history and high utilization will typically have a better score than someone with low utilization but missed payments.

Building good payment habits takes time and consistency. Making on-time payments toward installment loans helps build credit history similar to credit card payments. This includes car loans, student loans, and mortgages.

Even small payments count toward building positive payment history. Someone who can only afford minimum payments should prioritize making them on time. They can focus on paying larger amounts later when their financial situation improves.

The key is developing a system that works for individual circumstances. Some people prefer automatic payments while others like manual control. The important thing is choosing a method that ensures payments happen consistently on time.

Credit utilization measures how much of your available credit you use. It shows up as a percentage on your credit report.

Credit utilization is calculated as the ratio of all credit card balances to total credit limits. If someone has $1,000 in balances and $10,000 in total limits, their utilization rate is 10%.

This factor plays a major role in credit scores. Lenders use it to judge how well someone manages debt.

The 30% rule is a popular guideline for credit building. Experts advise using no more than 30% of credit card limits to keep utilization down.

For example, someone with a $5,000 credit limit should keep their balance under $1,500. This follows the basic 30% rule.

However, lower utilization rates work even better for credit scores. For best credit building, try to keep overall credit usage below 10% if possible.

Over 30% utilization is a red flag, but under 10% is best. Many people with excellent credit scores keep their utilization in single digits.

People can use their credit cards as much as they want during the month. The key is paying down balances before the statement closes.

Credit card companies report statement balances to credit bureaus. This reported balance determines the utilization rate that affects credit scores.

Someone might spend $3,000 on a card with a $5,000 limit during the month. If they pay it down to $500 before the statement date, their utilization shows as 10%.

There is a misconception that credit scores won’t be negatively affected unless total balance climbs above 30%. Even balances below 30% can hurt scores if they get too high.

People who exceed the 30% limit have several options. The first choice is paying off debt until balances drop under 30%.

They can transfer debts between cards to keep individual cards under 30%. This spreads balances across multiple cards.

Another option involves asking credit card companies for higher limits. This lowers utilization rates without paying down balances.

If someone has a $2,000 balance on a $5,000 limit card, their utilization is 40%. Getting the limit raised to $7,000 drops utilization to about 29%.

When carrying balances, aim to keep overall credit utilization under 30% and shoot for under 10% to achieve a top credit score. This approach helps maximize credit score potential.

Both individual card utilization and overall utilization matter for credit scores. Someone should watch both numbers carefully.

If one card has high utilization but others are low, it can still hurt credit scores. The scoring models look at individual cards too.

Credit utilization is one of the most important factors in determining credit scores. It typically makes up about 30% of a credit score calculation.

People building credit should check their utilization regularly. Many credit card apps show current balances and limits.

Setting up balance alerts helps people stay under their target utilization rates. These alerts warn when balances get too high.

Making multiple payments per month can keep utilization low. Instead of one monthly payment, someone might pay weekly or bi-weekly.

This strategy keeps reported balances lower throughout the month. It works especially well for people who use cards frequently.

The timing of payments matters for utilization rates. Paying before the statement date affects the reported balance.

Some people pay their full balance a few days before their statement closes. This can result in zero utilization being reported.

However, having some small amount of utilization might be better than zero. It shows active credit use to lenders.

A utilization rate between 1% and 10% often produces the best credit scores. This shows responsible credit use without overextension.

People with multiple cards should spread balances evenly when possible. Having one maxed-out card and others with zero balances isn’t ideal.

The Consumer Financial Protection Bureau recommends keeping credit utilization below 30% of total available credit. This federal agency guidance supports the common 30% rule.

Building good credit requires consistent attention to utilization rates. It’s one of the fastest ways to improve credit scores.

People who maintain low utilization over time often see steady credit score improvements. This habit demonstrates financial responsibility to future lenders.

Credit reports often contain mistakes that can hurt your credit score. These errors are more common than most people think.

Wrong information on your credit report can lower your score by many points. This makes it harder to get loans or credit cards.

Common errors include accounts that don’t belong to you. Sometimes reports show late payments you never made.

Other mistakes include wrong personal information like your name or address. Closed accounts might show as still open.

You should check your credit report for mistakes at least once per year. Look at each section carefully.

When you find an error, act fast. Credit report errors can damage your credit score if you don’t fix them quickly.

You can dispute errors with each credit bureau that shows the mistake. The three main bureaus are Experian, Equifax, and TransUnion.

Write a clear letter explaining what is wrong. Include copies of documents that prove your point.

Keep the original documents for yourself. Only send copies to the credit bureaus.

Most credit bureaus let you dispute errors online. This is often the fastest way to start the process.

You can also dispute by phone or mail. Phone disputes work well for simple mistakes.

The credit bureau has 30 days to look into your dispute. They must contact the company that reported the wrong information.

If the company can’t prove the information is correct, the bureau must remove it. This happens in many cases.

Sometimes the investigation takes longer than 30 days. The bureau will let you know if they need more time.

You should dispute the same error with all three credit bureaus. Each bureau keeps its own records.

An error might appear on one report but not the others. Check all three to be sure.

Keep records of everything you send. Save copies of letters and emails.

Write down phone call dates and who you talked to. This helps if you need to follow up later.

Some errors come back after you remove them. This is called re-insertion.

If this happens, you can dispute again. Send more proof to support your case.

The dispute process helps ensure your credit report shows accurate information. This protects your credit score.

You don’t need to pay anyone to dispute errors for you. You can do it yourself for free.

Credit repair companies charge money for something you can do on your own. Save your money and handle disputes directly.

Some errors are harder to dispute than others. Identity theft cases often take more work.

If someone opened accounts in your name, you’ll need to file a police report. This gives you more proof for your dispute.

Medical bills sometimes appear on credit reports by mistake. These can be especially confusing to sort out.

Get records from your doctor or insurance company. These documents help prove the error.

Student loan errors are also common. Loans might show the wrong balance or payment history.

Contact your loan servicer first. Get a letter showing the correct information.

Bankruptcies sometimes stay on reports too long. They should come off after 7 to 10 years.

If an old bankruptcy still shows up, dispute it with proof of the filing date.

Collections accounts often have errors too. The amount might be wrong or the debt might not be yours.

Ask the collection company to verify the debt in writing. They must prove you owe the money.

Joint accounts can cause confusion on credit reports. Make sure you’re only responsible for accounts you actually opened.

Divorced people often see their ex-spouse’s debts on their reports. Dispute these right away.

Some errors happen when people have similar names. Check that all accounts actually belong to you.

Mixed files occur when credit bureaus combine information from different people. This creates many errors at once.

Be patient during the dispute process. It can take several months to fix complex errors.

Don’t give up if your first dispute doesn’t work. You can try again with more evidence.

The Fair Credit Reporting Act gives you the right to accurate credit reports. Use this law to protect yourself.

Fixing errors can raise your credit score quickly. This makes disputing mistakes one of the best ways to improve your credit.

Your credit utilization ratio plays a major role in your credit score. This ratio shows how much credit you use compared to your total available credit.

A simple way to improve this ratio is to request a credit limit increase. When your limit goes up but your balance stays the same, your utilization drops automatically.

Here’s how the math works. If someone has a $5,000 credit limit with a $1,000 balance, their utilization is 20%. But if their limit increases to $10,000 with the same $1,000 balance, their utilization rate drops from 20% to 10%.

Most credit card companies allow customers to request limit increases online or by phone. Calling your credit card company and asking for a higher limit is a quick and easy way to improve your utilization ratio.

The process is usually straightforward. Card issuers will ask about current income, employment status, and monthly expenses. They use this information to decide if they can approve a higher limit.

Some companies offer automatic increases to customers with good payment history. Others require a formal request. Either way, the process typically takes just a few minutes to complete.

There are some things to consider before requesting an increase. Credit card companies may perform a hard inquiry on your credit report when you request a credit limit increase. This could cause a small, temporary drop in your credit score.

However, the long-term benefits usually outweigh this short-term impact. A lower utilization ratio can help improve your credit score over time.

The key is not to increase spending when your limit goes up. The benefit only works if you keep your balance the same or lower it. Higher spending would cancel out the positive effect on your utilization ratio.

Many experts suggest keeping utilization below 30% of your total credit limit. Even better is keeping it below 10% for the best impact on your credit score.

A credit limit increase makes these targets easier to reach. More available credit means the same balance represents a smaller percentage of your total limit.

Some people worry that having higher credit limits might tempt them to spend more. If someone struggles with overspending, they should consider this carefully before requesting an increase.

For those who can control their spending, a higher credit limit offers mostly benefits. It provides more financial flexibility and can help improve credit scores through better utilization ratios.

The timing of your request matters too. It’s best to ask when your account is in good standing with recent on-time payments. Having steady income and low debt also helps your chances of approval.

If one credit card company denies your request, you can try again in a few months. Your financial situation might improve, or the company’s lending criteria might change.

You can also apply this strategy across multiple credit cards. If you have several cards, requesting increases on each one can significantly boost your total available credit.

Remember that the goal is to create more breathing room in your utilization ratio. More credit means the ratio of debt to credit is farther apart, giving you a lower credit utilization ratio.

This hack works best when combined with other good credit habits. Making payments on time, keeping balances low, and maintaining old accounts all work together to build stronger credit.

A credit limit increase is one of the fastest ways to see improvement in your utilization ratio. Unlike paying down debt, which takes time, a limit increase can lower your utilization immediately.

The impact on your credit score may take a month or two to show up. Credit reporting agencies need time to process the changes and update your credit report.

Some credit card companies are more generous with limit increases than others. Research shows that some issuers regularly review accounts and offer increases proactively.

Building a good relationship with your credit card company helps too. Customers who use their cards regularly and pay on time are more likely to get approved for increases.

If you’re new to credit or have had past problems, start with smaller increase requests. Asking for too much too soon might result in a denial.

This strategy works particularly well for people who already practice good spending habits. They get the benefit of lower utilization without the risk of accumulating more debt.

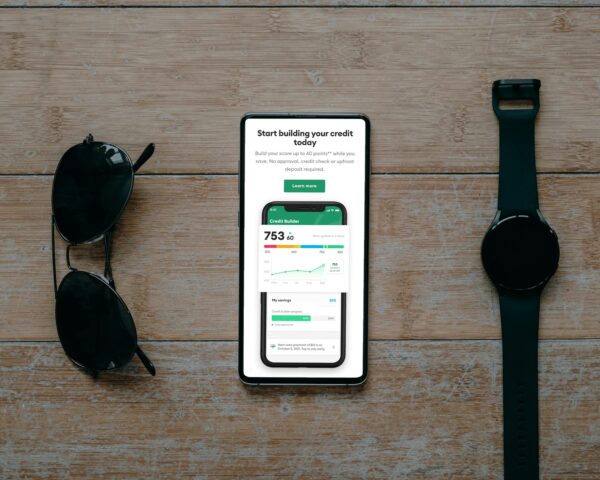

A credit builder loan works differently than regular loans. Instead of getting money upfront, borrowers make payments first and receive the funds later.

The bank holds the loan amount in a savings account or certificate of deposit. Borrowers make monthly payments toward this secured amount. Each payment gets reported to the three major credit bureaus.

This payment history helps build a positive credit profile over time. Most credit builder loans range from $300 to $3,000 with terms lasting 6 to 24 months.

Banks and credit unions typically offer the most reliable credit builder loan programs. They follow strict federal regulations and provide transparent terms. Online lenders also offer these products but require careful research.

Credit unions often provide the best rates and terms for members. Many community banks also offer competitive credit builder loan options. These institutions want to help customers establish long-term banking relationships.

Payment amounts can start as low as $10 per month with some lenders. The Credit Karma Credit Builder allows flexible payment schedules without required monthly minimums.

Borrowers should verify that lenders report to all three credit bureaus. Experian, Equifax, and TransUnion all need to receive payment information for maximum credit building impact.

Most credit builder loans charge minimal fees or interest rates. Banks typically charge between 6% to 16% annual percentage rates. Credit unions often offer lower rates to their members.

The loan term affects how quickly credit scores improve. Longer terms provide more months of positive payment history. However, shorter terms mean less interest paid overall.

Borrowers receive their money back once they complete all payments. Some lenders add earned interest to the final payout. This creates a forced savings plan while building credit simultaneously.

Late payments can damage credit scores instead of helping them. Borrowers must ensure they can afford the monthly payment amount. Setting up automatic payments prevents missed due dates.

Most lenders require a checking or savings account at their institution. This helps them verify income and manage the loan process. Some online lenders work with external bank accounts.

Credit builder loans work best for people with no credit history. They also help those recovering from past credit problems. People with existing good credit may not see significant score improvements.

Results typically appear on credit reports within 30 to 60 days. Credit scores may start improving after three to six months of consistent payments. Building strong credit takes patience and consistent effort.

Some lenders offer graduation programs to traditional credit products. Borrowers can qualify for regular loans or credit cards after completing their credit builder loan. This helps establish ongoing banking relationships.

The loan amount affects monthly payment size but not credit building effectiveness. A $500 loan builds credit just as well as a $2,000 loan. Borrowers should choose amounts they can comfortably afford.

Banks may require minimum credit scores even for credit builder loans. Others accept borrowers with no credit history at all. Each institution sets its own approval requirements.

Application processes are usually simple and straightforward. Most banks can approve credit builder loans within one business day. Online applications make the process even faster for many lenders.

Borrowers should read all loan terms carefully before signing. Understanding fees, interest rates, and payment schedules prevents surprises later. Some loans include early payoff options without penalties.

Credit builder loans create installment loan history on credit reports. This adds variety to credit profiles beyond just credit card accounts. Mixed account types can improve overall credit scores.

The forced savings aspect appeals to many borrowers. They build credit while setting money aside for future needs. This dual benefit makes credit builder loans attractive financial tools.

Borrowers must continue making payments even during financial difficulties. Missing payments damages credit scores and defeats the loan’s purpose. Emergency funds help maintain consistent payment schedules.

Some employers offer credit builder loans as employee benefits. Community development financial institutions also provide these products. These sources may offer better terms than traditional banks.

Successful completion of a credit builder loan demonstrates financial responsibility. This positive payment history stays on credit reports for up to 10 years. The long-term credit benefits justify the short-term commitment required.

Becoming an authorized user on someone else’s credit card can help people build credit without opening their own account. This strategy works well for those starting from scratch or recovering from past financial problems.

An authorized user gets permission to make purchases on another person’s credit card account. The primary account holder remains responsible for all payments and account management.

The authorized user strategy helps build credit when the account gets reported to credit bureaus. Most major credit card companies report authorized user activity to all three credit bureaus.

The primary account holder’s payment history appears on the authorized user’s credit report. Good payment habits from the primary user can boost the authorized user’s credit score over time.

Credit utilization from the account also affects the authorized user’s credit profile. Low balances relative to the credit limit help both parties maintain good credit scores.

The age of the credit account matters for building credit history. Older accounts with good payment records provide more value than newer accounts.

People should choose their primary account holder carefully. The account must have a history of on-time payments and low credit utilization to provide benefits.

Family members often serve as good options for authorized user arrangements. Parents frequently add their children to help them establish credit before college or entering the workforce.

Both parties need to manage the account responsibly for the strategy to work. Poor management can hurt both credit scores.

The authorized user should discuss spending limits and expectations with the primary account holder. Clear communication prevents overspending and relationship problems.

Some credit cards charge fees for adding authorized users. These fees typically range from zero to fifty dollars per year depending on the card issuer.

The authorized user can remove themselves from the account at any time. They need to contact the credit card company directly to request removal.

Primary account holders can also remove authorized users whenever they choose. This flexibility makes the arrangement less risky than other credit-building methods.

Credit card companies may require basic information about the authorized user. This usually includes their name, date of birth, and Social Security number.

The authorized user receives their own physical credit card with their name on it. They can make purchases anywhere the card is accepted.

Authorized users can practice using credit responsibly while building their credit history. This hands-on experience helps them develop good financial habits.

Some people use this strategy temporarily while working on other credit-building methods. They may apply for their own credit cards once their scores improve.

The credit boost from authorized user status can happen relatively quickly. Some people see improvements in their credit scores within one to two months.

However, the impact depends on the primary account holder’s credit management. Accounts with high balances or late payments can actually harm the authorized user’s credit.

People should monitor their credit reports after becoming authorized users. This helps them track improvements and catch any potential problems early.

The strategy works particularly well for young adults who need to establish credit for the first time. It gives them a head start before applying for student loans or their first credit card.

Immigrants new to the United States also benefit from this approach. It helps them build American credit history even without previous U.S. financial records.

The authorized user arrangement does not require a credit check or income verification. This makes it accessible to people who might not qualify for their own credit cards yet.

Some credit scoring models give less weight to authorized user accounts than primary accounts. However, the accounts still contribute positively to most credit scores.

People should view this strategy as one part of a broader credit-building plan. Combining it with other methods typically produces better long-term results.

The arrangement works best when both parties treat it seriously and communicate regularly about account activity and goals.

High-interest credit cards can seriously damage someone’s credit score and financial health. When balances carry over month to month, interest charges pile up quickly.

Credit card debt grew 10% in 2023, with the average balance reaching $6,501. This shows how common this problem has become for many people.

Paying off high-interest cards first makes mathematical sense. These cards cost the most money over time through interest charges.

The debt avalanche method targets the highest interest rate cards first. This approach saves the most money in total interest payments compared to other strategies.

Someone with multiple credit cards should list them by interest rate. The card with the highest rate gets priority for extra payments while making minimum payments on others.

This strategy requires discipline but delivers clear financial benefits. Every dollar put toward high-interest debt saves money that would otherwise go to interest charges.

Credit utilization plays a major role in credit scores. High balances relative to credit limits hurt scores significantly.

Paying down high-interest cards reduces utilization ratios. Lower utilization typically leads to better credit scores within a few months.

Focus extra money on the card with the highest interest rate first. Once that card is paid off, move to the next highest rate card.

Making only minimum payments on high-interest cards means most of the payment goes to interest. Very little reduces the actual balance owed.

Someone paying $100 monthly on a card with 24% interest might only reduce the balance by $20. The other $80 goes straight to interest charges.

Paying more than the minimum changes this equation dramatically. Extra payments go directly toward reducing the principal balance.

High-interest credit cards often charge rates between 18% and 29%. These rates make it extremely difficult to pay off balances with minimum payments alone.

People should avoid adding new charges to cards they’re trying to pay off. New purchases make it harder to reduce balances and improve credit scores.

Strategies to lower interest rates can help make payments more effective. Some card companies will negotiate lower rates for good customers.

Balance transfer cards with 0% introductory rates can provide temporary relief. However, these should be used carefully as part of a complete payoff plan.

Store credit cards typically carry some of the highest interest rates. These cards should often be the first priority for payoff efforts.

Someone juggling multiple high-interest cards needs a clear plan. Writing down balances, minimum payments, and interest rates helps create focus.

Emergency funds become more important when paying off high-interest debt. This prevents the need to use credit cards for unexpected expenses.

Side income or temporary spending cuts can accelerate the payoff process. Every extra dollar put toward high-interest debt provides immediate returns through avoided interest.

The psychological benefit of eliminating high-interest debt is significant. Removing these monthly payments frees up money for other financial goals.

Credit scores typically improve as high-interest balances decrease. Payment history and credit utilization both benefit from this focused approach.

Someone with excellent payment history but high balances will see scores rise as balances fall. This improvement often happens within 30 to 60 days.

High-interest credit card debt creates a cycle that’s hard to break. Interest charges make balances grow even when making regular payments.

Breaking this cycle requires paying more than the minimum amount due. The extra payment amount should go to the highest rate card first.

Tax refunds, bonuses, or other windfalls should target high-interest debt. These lump sum payments can dramatically reduce payoff time.

Many people underestimate how much they pay in credit card interest annually. Calculating this total amount often provides motivation to pay off balances faster.

Someone paying 25% interest on a $5,000 balance will pay over $1,200 per year in interest alone. This money could go toward savings or other financial goals instead.

High-interest credit cards should be kept open after payoff in most cases. Closing them can hurt credit scores by reducing available credit.

The key is using these cards responsibly after payoff. Small purchases paid off monthly can help maintain the accounts without creating new debt problems.

Opening several new credit accounts in a short time can hurt your credit score. Lenders see this behavior as risky and it raises red flags about your financial stability.

Each time you apply for new credit, the lender performs a hard inquiry on your credit report. These inquiries temporarily lower your credit score by a few points. Multiple inquiries in a short period create a bigger negative impact.

New accounts also reduce the average age of your credit history. Credit scoring models favor longer credit histories because they show consistent financial behavior over time.

Opening multiple credit accounts may seem convenient for managing finances and taking advantage of rewards. However, it can negatively impact your credit utilization ratio and lead to higher finance charges.

Rapid account opening can make you appear desperate for credit. This pattern suggests potential financial problems to lenders and credit scoring algorithms.

New credit accounts often come with promotional offers and sign-up bonuses. While these perks seem attractive, they should not drive decisions about opening accounts you don’t actually need.

Store credit cards frequently offer immediate discounts at checkout. You should especially avoid opening these accounts if you’re about to apply for a mortgage or another major loan.

The timing of new account applications matters significantly. Avoid opening new credit lines within six months of applying for important loans like mortgages or auto loans.

Credit card companies target consumers with pre-approved offers and promotional rates. These marketing tactics encourage people to open accounts they may not need or be able to manage properly.

Young adults often receive multiple credit card offers when they start building credit. For individuals under 40, establishing good credit is about laying a solid financial foundation rather than maximizing the number of accounts.

Having too many new accounts can make it harder to track spending and payment due dates. This increases the risk of missing payments, which damages credit scores more than account opening.

New accounts require active management to maintain good standing. Each additional account adds complexity to your financial routine and increases the chance of mistakes.

Credit utilization becomes more challenging to manage with multiple new accounts. You need to monitor balances across all cards to keep your overall utilization ratio low.

Some people open multiple accounts to increase their total available credit. While this can help utilization ratios, the negative effects of multiple inquiries and reduced account age often outweigh the benefits.

The credit scoring impact varies based on your existing credit profile. People with thin credit files experience more significant score drops from new account openings than those with established credit histories.

Following logic about credit history length, you should avoid opening new credit lines because it reduces the average age of your accounts by default.

Lenders prefer to see stable credit behavior over time. Rapid account opening suggests impulsive financial decisions rather than thoughtful credit management.

The negative impact of new accounts typically diminishes after six to twelve months. However, the accounts will continue to affect your average account age for years.

Credit experts recommend spacing out new account applications by at least six months. This allows your credit score to recover between applications and shows more responsible credit-seeking behavior.

Emergency situations may require new credit accounts, but these should be rare exceptions. Planning ahead for major purchases helps avoid the need for multiple rapid credit applications.

Building better credit is a marathon, not a sprint. Patient credit building with existing accounts often produces better results than rapidly expanding your credit portfolio.

Focus on managing existing accounts well before considering new ones. Pay balances on time, keep utilization low, and maintain accounts in good standing.

The key is being selective about new credit accounts. Only open accounts that serve a specific purpose in your financial plan and that you can manage responsibly.

Setting up automatic payments helps ensure bills get paid on time, preventing late fees and damage to credit scores. This simple step removes the risk of forgetting due dates or losing track of payment schedules.

Missed payments can have a significant negative impact on credit scores. Payment history makes up 35% of a credit score calculation, making it the most important factor lenders consider.

Late payments stay on credit reports for seven years. Even one missed payment can drop a credit score by 60 to 110 points, depending on the person’s current score and credit history.

Bill automation involves setting up automatic payments for recurring bills, such as rent, mortgage, utilities, and subscriptions. The service provider deducts the necessary funds on the due date after the person provides payment information.

Most banks and credit unions offer automatic payment services through their online banking platforms. Credit card companies, utility providers, and loan servicers also provide autopay options directly through their websites or mobile apps.

Automatic payments work well for fixed bills like rent, mortgage, and insurance. These bills have consistent amounts each month, making them ideal candidates for full automatic payments.

For variable bills like credit cards or utilities, people should consider setting up minimum payment automatically to avoid late fees. They can then pay any remaining balance manually to avoid interest charges or reduce debt faster.

Setting up automatic minimum payments on credit cards, loans, and utilities reduces the risk of missed payments. People can still make extra payments manually to pay down balances or avoid interest.

Credit card autopay offers several options. People can choose to pay the minimum amount, full balance, or a fixed dollar amount each month. Paying the full balance automatically helps avoid interest charges entirely.

For student loans, automatic payments often come with interest rate reductions. Many lenders offer a 0.25% interest rate discount when borrowers sign up for autopay, saving money over the life of the loan.

Mortgage and auto loan autopay ensures these major payments never get missed. Since these are typically the largest monthly payments, missing them can cause serious credit damage and potential repossession or foreclosure proceedings.

People need to keep billing information up to date across accounts. If bank or card information expires or changes, automatic payments will stop working and bills may become overdue.

Account holders should monitor their bank statements regularly even with autopay enabled. This helps catch any billing errors, fraudulent charges, or unexpected payment amounts before they cause problems.

Setting up automatic payments requires sufficient funds in the linked account. People should maintain adequate account balances and consider overdraft protection to prevent failed payments and associated fees.

Some people worry about losing control over their finances with automatic payments. However, they can still review statements and cancel or modify autopay arrangements at any time through their bank or service provider.

Scheduling automatic payments a few days before due dates provides a buffer for processing time. This prevents late payments even if there are minor delays in the banking system.

For people with irregular income, automatic payments for essential bills like housing and utilities should take priority. They can set up autopay for these critical payments first, then add other bills as their financial situation stabilizes.

Mobile banking apps make managing automatic payments easier than ever. Most apps allow users to set up, modify, or cancel autopay arrangements directly from their smartphones.

Automatic payments give people peace of mind knowing payments won’t get lost in the mail or stolen from mailboxes. This eliminates concerns about check fraud or mail delays affecting payment timing.

People should start with one or two bills when beginning to use automatic payments. This allows them to get comfortable with the process before automating all their monthly obligations.

Emergency fund maintenance becomes more important with automatic payments. Having three to six months of expenses saved helps ensure autopay continues working even during financial difficulties or job loss.

Automating bills eliminates the stress of missed payments and helps maintain financial stability. This consistent payment history demonstrates reliability to future lenders and creditors.

Regular account monitoring remains essential even with autopay enabled. People should check their accounts weekly to ensure payments processed correctly and account balances remain adequate for upcoming automatic deductions.

Credit mix refers to the different types of credit accounts a person has on their credit report. Lenders want to see that borrowers can handle various types of debt responsibly.

The two primary credit types are installment and revolving credit. Each type works differently and shows lenders different skills in money management.

Revolving credit allows people to borrow up to a set limit, make payments, and then use the credit again. Credit cards are the most common example of revolving credit.

Personal lines of credit and home equity lines of credit also count as revolving accounts. These accounts let borrowers access money as needed up to their credit limit.

Installment credit works differently than revolving credit. With installment loans, borrowers receive a fixed amount of money upfront and pay it back in equal monthly payments.

Common installment loans include car loans, personal loans, mortgages, and student loans. These loans have set payment amounts and specific end dates.

A mix of installment loans and revolving credit accounts shows lenders that someone can handle various financial responsibilities. This variety demonstrates good money management skills.

Credit mix makes up about 10% of a person’s overall credit score. While this percentage is smaller than payment history or credit usage, it still matters for building strong credit.

People with only credit cards miss out on showing they can handle fixed monthly payments. Those with only installment loans cannot prove they manage revolving credit well.

The best approach involves having both types of credit accounts. This shows lenders a complete picture of someone’s ability to manage different kinds of debt.

New credit users should start with one type of account and add variety over time. Opening too many accounts at once can hurt credit scores in the short term.

Credit cards often serve as good starting points for building credit mix. They help establish payment history while providing revolving credit experience.

Adding an installment loan later can improve credit diversity. Auto loans or personal loans work well for this purpose when someone needs to make a major purchase.

Student loans also count as installment credit for those pursuing education. These loans can help build credit mix while funding college expenses.

Mortgages represent another form of installment credit that many people eventually obtain. Home loans show lenders that someone can handle large, long-term debt responsibilities.

Maintaining both installment and revolving credit accounts requires careful management. People must make all payments on time across different account types.

Each account type has different payment structures and requirements. Revolving accounts need minimum payments that change based on balances used.

Installment accounts require fixed monthly payments that stay the same throughout the loan term. Missing payments on either type can damage credit scores significantly.

People should avoid opening new accounts just to improve credit mix. Each new account requires a credit check that can temporarily lower credit scores.

Instead, they should focus on accounts they actually need and can afford. This approach builds credit mix naturally while serving real financial purposes.

Credit mix becomes more important as people develop longer credit histories. Advanced credit users benefit more from having diverse account types.

Those just starting to build credit should prioritize payment history and low credit usage first. Credit mix can be developed gradually over time.

The key involves managing whatever accounts someone has responsibly rather than rushing to open many different types. Quality management matters more than quantity of accounts.

People should keep older accounts open when possible to maintain their credit mix over time. Closing accounts can reduce the variety of credit types on their reports.

Different credit types show lenders various financial management skills. This diversity can help people qualify for better rates and terms on future loans.

Lenders see borrowers with mixed credit types as less risky than those with only one type. This perception can lead to better loan offers and higher credit limits.

Building good credit mix takes time and patience. People should focus on using credit responsibly rather than trying to achieve perfect mix quickly.

The goal involves showing lenders that someone can handle different types of financial obligations successfully. This demonstration comes through consistent, on-time payments across various account types.

Credit mix works best when combined with other good credit habits. Low balances, timely payments, and long credit history all work together to build strong credit scores.

People should monitor their credit reports regularly to understand their current mix of accounts. This knowledge helps them make informed decisions about future credit needs.

Credit scores range from 300 to 850, with higher numbers indicating better creditworthiness. The calculation involves five key factors, and credit inquiries can temporarily lower scores by a few points.

Credit scores use five main factors that FICO uses to calculate scores. Each factor carries different weight in the final score calculation.

Payment history makes up 35% of the score. This includes on-time payments, late payments, and any missed payments. Even one late payment can drop a score by 50-100 points.

Credit utilization accounts for 30% of the score. This measures how much credit someone uses compared to their total available credit. Keeping utilization below 10% helps maintain higher scores.

Length of credit history represents 15% of the calculation. Older accounts boost scores because they show a longer track record of credit management.

Credit mix contributes 10% to the score. Having different types of credit like credit cards, auto loans, and mortgages can improve scores.

New credit inquiries make up the final 10%. Opening multiple new accounts in a short time can lower scores temporarily.

Credit inquiries fall into two categories: hard inquiries and soft inquiries. Hard inquiries occur when lenders check credit for loan applications. Soft inquiries happen during background checks or credit monitoring.

Hard inquiries can lower credit scores by 5-10 points each. The impact typically lasts 12 months, though inquiries remain on credit reports for two years.

Multiple inquiries for the same type of loan within 14-45 days count as one inquiry. This allows rate shopping without major score damage.

Soft inquiries do not affect credit scores at all. These include checking personal credit reports, pre-approved offers, and employer background checks.

The timing of inquiries matters most when planning major purchases like homes or cars.

Building credit requires avoiding two major pitfalls that can damage your credit score for years. Late payments can take years to recover from, while maxed-out credit cards create high utilization ratios that lower scores immediately.

Payment history makes up 35% of a person’s credit score. This makes it the most important factor that credit bureaus consider when calculating scores.

Late Payment Timeline:

A single late payment can drop a good credit score by 60 to 110 points. The damage stays on credit reports for seven years.

People often forget due dates or assume grace periods exist when they don’t. Credit card companies typically report late payments to credit bureaus once they are 30 days overdue.

Prevention strategies include setting up automatic payments for at least the minimum amount. Phone reminders and calendar alerts also help people stay on track with payment dates.

Using too much available credit creates high utilization ratios that hurt credit scores. Credit utilization accounts for 30% of a person’s credit score calculation.

Recommended utilization levels:

Someone with a $1,000 credit limit should keep balances below $100 for the best credit score impact. Balances above $300 start causing noticeable score drops.

Maxing out cards can lead to high credit utilization ratios even if payments are made on time. Credit bureaus typically receive balance information on statement closing dates.

People can lower utilization by making multiple payments per month or requesting credit limit increases. Spreading balances across multiple cards also helps keep individual card utilization low.

People often want to know how quickly they can improve their credit scores and what methods work best. The timeline for credit improvement varies based on individual circumstances and the strategies used.

Making on-time payments stands as the most powerful way to boost credit scores. Payment history makes up 35% of a credit score calculation.

Keeping credit card balances below 30% of the available limit helps immediately. Lowering credit utilization can show results within one billing cycle.

Disputing errors on credit reports can remove negative items quickly. Credit bureaus must investigate disputes within 30 days by law.

Requesting credit limit increases from existing card companies lowers utilization ratios. This strategy works best for people with good payment histories.

Raising a credit score by 100 points in 30 days is extremely rare and usually only happens when major errors get removed. Building credit is a marathon, not a quick fix.

People with very low scores have the best chance of seeing large increases. Removing collections accounts or correcting identity theft can create dramatic improvements.

Most people see increases of 10-30 points per month with consistent effort. Paying down high balances and fixing report errors offer the fastest legitimate results.

People with no credit history need to establish accounts first. Secured credit cards require deposits but help build payment history.

Credit builder loans from banks create installment loan history. These loans hold the borrowed money in savings until payments complete.

Becoming an authorized user on someone else’s account can add positive history. The primary cardholder’s good habits benefit the authorized user’s score.

Paying utility bills and rent through credit-building services adds payment history. Some services report these payments to credit bureaus for a monthly fee.

Credit builder loans can improve scores by adding payment history and credit mix. These loans typically increase scores by 20-60 points over 12-24 months.

Banks and credit unions offer the most reliable credit builder loans. Online lenders may charge higher fees or offer less favorable terms.

Making payments on time for the entire loan term maximizes the benefit. Late payments hurt credit scores and defeat the loan’s purpose.

Keeping the loan account open adds to credit age. Closing accounts immediately after payoff reduces the long-term credit building benefit.

True overnight credit score improvements are impossible through legitimate means. Credit bureaus typically update scores monthly when new information arrives.

Paying down credit card balances before statement dates can show quick results. The new lower balance reports to bureaus within 30 days.

Requesting rapid rescoring through a mortgage lender speeds up certain updates. This service costs money and only works for specific situations like home buying.

Challenging inaccuracies on credit reports offers the fastest legitimate path to improvement. Successful disputes can remove negative items within weeks.

Maintaining payment history without any late payments is essential for 800+ scores. Even one 30-day late payment can drop scores significantly.

Keeping credit utilization below 10% helps reach the highest score ranges. People with 800+ scores typically use less than 7% of available credit.

Maintaining 2-3 major credit cards provides optimal credit mix. Having both revolving and installment accounts shows responsible management.

Keeping old accounts open preserves credit age and available credit. The average account age for 800+ scores is typically 10+ years. 10 Hacks for Building Credit.